What is FxWirePro™ Currency Index?

The FxWirePro™ Currency Index take a real-world, transparent approach to measuring economically significant currencies in real-time. The Indices are offered by FxWirePro™, a premier global financial analysis provider.

The value of Currency Index varies from 0 to infinity and minus infinity. If the value of Index is more than 75 it is considered as slightly bullish and highly bullish if it is above 100. Similarly, if it is around -75 and -100 it is slightly bearish and highly bearish if it is below -100. Currently available are the following Indices:

The Dollar Index calculates the strength of US dollar against all major currency pairs. The components are EUR/USD, USD/JPY, USD/CHF, GBP/USD, USD/CAD, AUD/USD and NZD/USD. The strength of each pair is calculated by using the assigned weightages by taking appropriate volumes into consideration with respect to others to get overall Index strength.

The EUR Index calculates the strength of EUR against all major currency pairs. The components are EUR/USD, EUR/JPY, EUR/CHF, EUR/GBP, EUR/CAD, EUR/AUD and EUR/NZD.

The GBP Currency Index calculates the strength of EUR against all major currency pairs. The components are GBP/USD, EUR/GBP, GBP/CHF, GBP/JPY, GBP/CAD, GBP/AUD and GBP/ NZD.

The JPY Index calculates the strength of EUR against all major currency pairs. The components are USD/JPY, EUR/JPY, CHF/JPY, GBP/JPY, CAD/JPY, AUD/JPY and NZD/JPY.

The NZD Index calculates the strength of NZD against all major currency pairs. The components are NZD/USD, EUR/NZD, GBP/NZD, NZD/JPY, NZD/CAD, GBP/NZD and AUD/ NZD.

The AUD Index calculates the strength of AUD against all major currency pairs. The components are AUD/USD, EUR/AUD, GBP/AUD, AUD/JPY, AUD/CAD, GBP/AUD and AUD/ NZD.

The CHF Index calculates the strength of CHF against all major currency pairs. The components are USD/CHF, EUR/CHF, GBP/CHF, CHF/JPY, CAD/CHF, NZD/CHF and AUD/CHF.

The CAD Index calculates the strength of CAD against all major currency pairs. The components are USD/CAD, EUR/CAD, GBP/CAD, CAD/JPY, CAD/CHF, NZD/CAD and AUD/CAD.

How to Trade using the Currency Index?

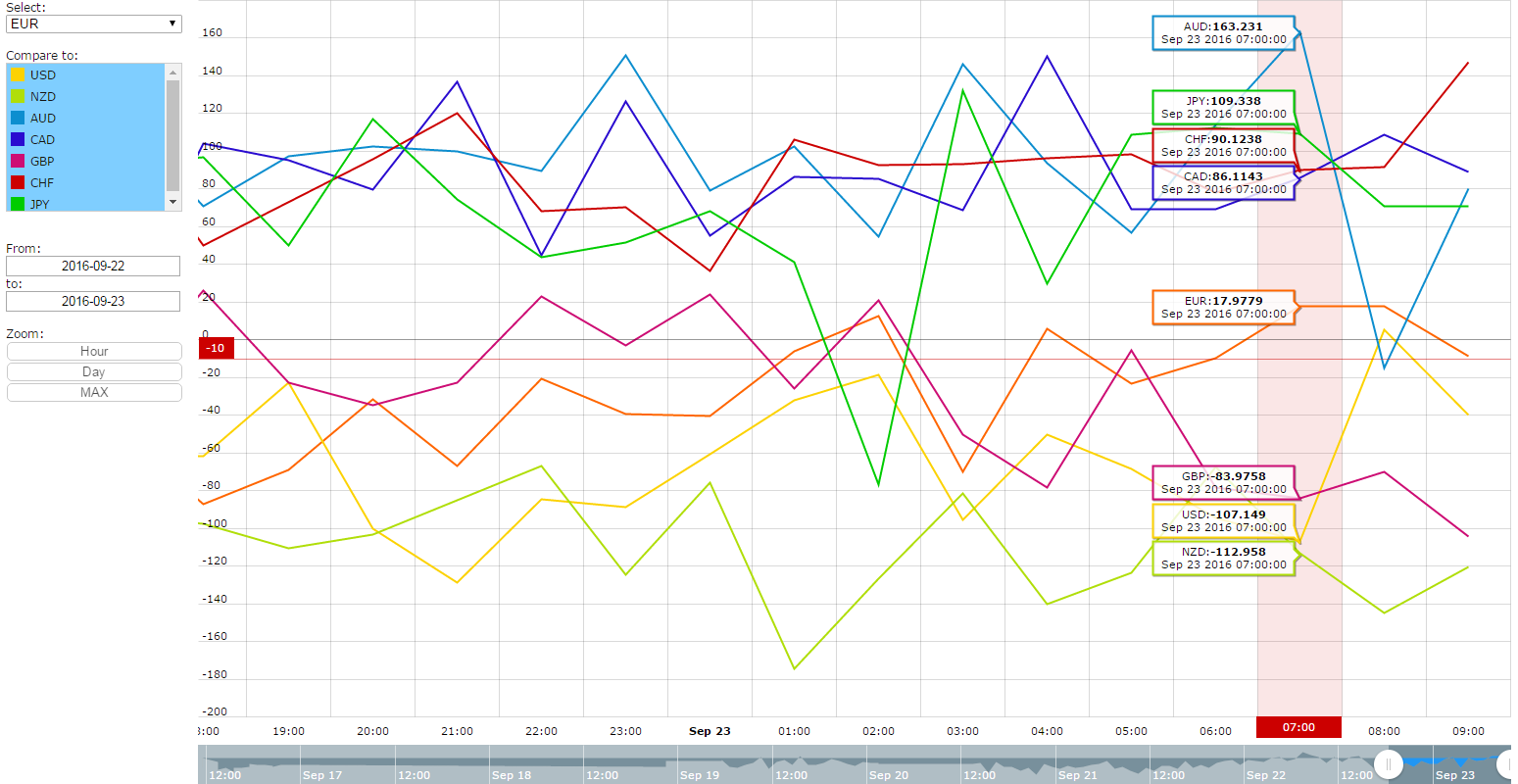

For example, the currency strength Index of various pairs at 7 GMT (Sep 23rd 2016) shows

- USD-107.14 (Highly bearish) (above -100)

- EUR17.97

- GBP-83.9758 (slightly bearish) (above -75)

- AUD163.23 (Highly bullish) (above 100)

- NZD-112.95 (Highly bearish) (above -100)

- CAD86.11

- CHF90.12

- JPY 109.33 (Highly bullish) (above 100)

Traders can go:

- Long on AUD and short on USD. (Buy AUD/USD)

- Long on AUD and short on NZD (Buy AUD/NZD)

- Long on JPY and short on USD (Sell USD/JPY)

- Long on CAD and short on GBP (Sell GBP/CAD (slightly bearish)

How Do You Actually Trade News?

There are 3 methods to news trading: the Pre News Trade, Spike Trade, and Retracement Trade.

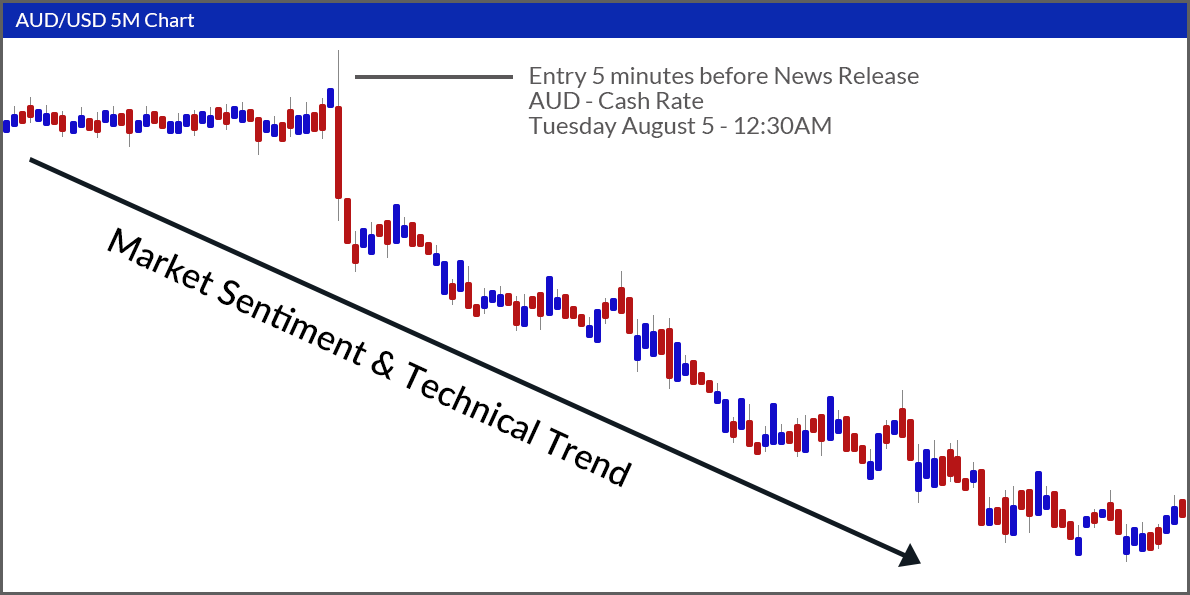

1. Pre-News

With Pre-News trade, you enter the market 5 minutes before the news release.

You base your entry on market sentiment and fundamental trend of the currency pair and youalways trade the direction of the Technical Trend.

If the news release goes as you expected, you can make the entire move.

But if the news release goes against your expectation, you may have to endure the initial drawdown,

but usually after the impact is over, technical trend will resume its course and give us an exit to break even or minimal loss.

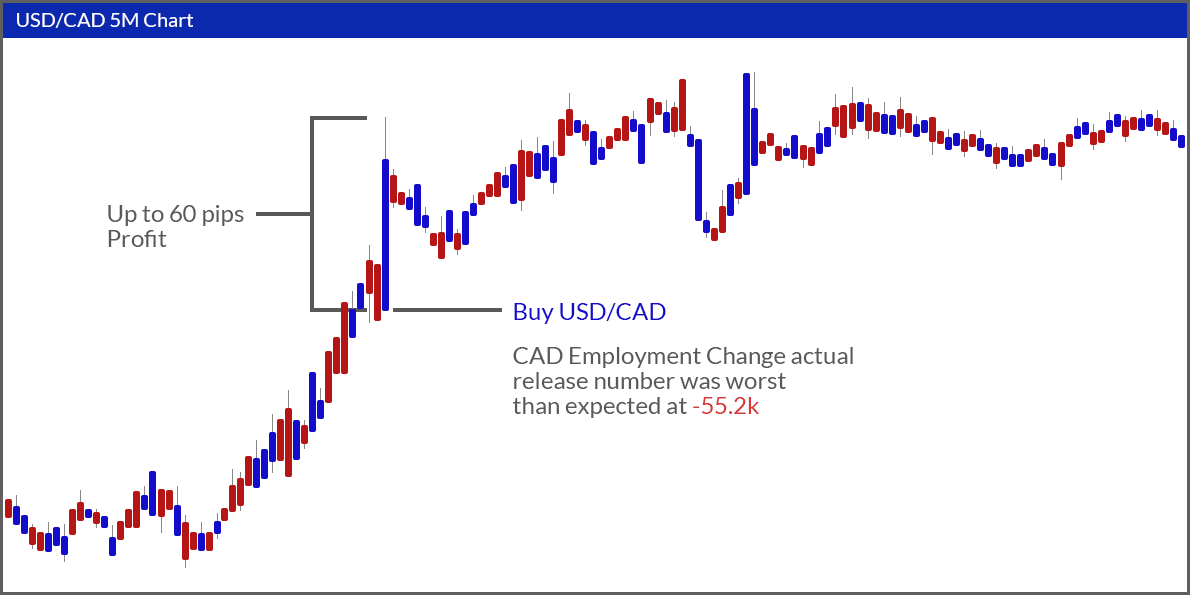

2. Spike

With Spike trade, you wait for the news release to come out. Based on the release number youenter the market immediately either with a Long or a Short position.

You try to catch the initial spike move, or part of the move.

You also put reasonable Stop/Loss (i.e.20 pips) from the

pre-release price and your Take/Profit at the maximum expected range based on the report and its historical data.

This type of trading requires that you react fast enough to the release and use a broker that gives you good fill during news releases

3. Retracement

With Retracement trade, you wait for the news release to come out. Based on the release number you determine “where” to get into the market.

Usually you have to wait for the market to come back within 10 to 15 pips of the pre-release depending on the actual deviation. You then put a Stop/Loss at X pips from the entry price.

You take profit at least 25% of the position when we get 10~20 pips of profit, and at least 50% of the position when we retest the top or the spike.

This type of trade is safer than trading the spike, but sometimes we might not get a retracement at all or big enough and miss the trade altogether.